Emerald Oil, Inc. could cut its Bakken drilling program the first quarter of next year if the price of oil continues to drop. Emerald's CEO McAndrew Rudisill announced the company's plans in a conference call for investors this week.

With WTI now below $80, we could see the first shoes begin to drop among some Bakken producers. According to the consultancy Wood Mackenzie, breakeven oil prices range from $60 to $80 per barrel in North Dakota's Bakken.

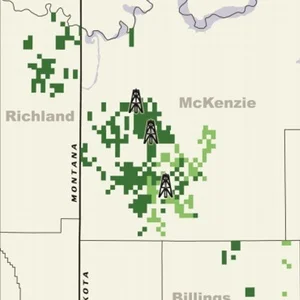

Emerald's current three-rig drilling program is slated to continue in the Bakken through the end of the year, but the contract for one of its rigs expires in the first quarter of next year (March 15, 2015), and the company may not renew it.

“According to Rudisill, the company’s decision will be determined largely by what is happening with WTI crude oil price.”We have to respond to large changes in the price of crude oil, said Rudisill. We will make a decision in the middle of March 2015 on whether or not to lay down the third rig.”

During the third-quarter of 2014, Emerald increased its production 3% quarter-on-quarter to 3,855 boe/d, and during the fourth-quarter, the company expects to produce 4,300 boe/d. The company missed its production guidance for the third quarter by 8%, citing mandated North Dakota road shutdowns due to poor weather conditions. Guidance was also reduced 6.5% for the fourth-quarter because of down-time expected from artificial lift installations, which were originally scheduled for the third quarter.

Emerald's capital budget for 2015 is $210 - $240-million.

Read more at emeraldoil.com