Wishing you a safe and happy Memorial Day. Please take a minute today to remember those who sacrificed so much for our quality of life.

North Dakota Officials Optimistic

Optimism was the order of the day at the Williston Basin Petroleum Conference and Expo held Wednesday in Bismark.

Related: Bakken Production Down 4.6% Over 2014

The downturn caused by depressed oil prices has had a huge effect on North Dakota. But despite rig counts in the twenties and crude prices still fluctuating, officials continue to believe that good things are ahead for the region. Even though the state has seen a revenue shortfall, Governor Jack Dalrymple says the state's economy remains strong thanks to the work and investment of the energy industry.

“From our perspective, we think that this industry in North Dakota is as solid as solid can be,” Governor Dalrymple said. “We couldn’t be more optimistic of what is ahead of us (...) and we see recovery on the horizon.”

Many believe that North Dakota's oil and gas activity will begin recovering when oil hits $60 a barrel. This price-point is looking more and more conceivable since prices have been flirting with $50 for the last few weeks.

State Mineral Resources Director Lynn Helms likened North Dakota's oil future to a stock car race that has just begun, saying, "We're on lap 100 of a 500-lap race."

Bakken Rig Count at 25

Bakken Rigs

The Bakken-Three Forks rig count fell this week with 25 rigs running across our coverage area by midday Friday.

A total of 414 oil and gas rigs were running across the United States this week, down five from last week. 86 were targeting natural gas (one less than the previous week) and 328 were targeting oil in the U.S. (four less than the previous week). The remainder were drilling service wells (e.g. disposal wells, injection wells, etc.)25 of the rigs active in the U.S. were running in North Dakota.

Bakken Oil & Gas Rigs

Bakken oil rigs fell to 25 this week with Bloomberg reporting WTI oil prices dipping to $44.62 on Friday afternoon. WTI-Brent also decreased this week to $45.32. The Bakken has zero natural active gas rig in the area this week with futures trading to $2.10/mmbtu by midday.

McKenzie County continues to lead development with 12 rigs running this week, far outpacing other counties. View the full list below under the Bakken Drilling by County section.

Activity continues to be dominated by horizontal drilling:

- 25 rigs are drilling horizontal wells

- 0 rigs are drilling directional wells

- 0 rigs are drilling vertical wells

Bakken Drilling by County

What is the Rig Count?

The Bakken Shale Rig Count is an index of the total number of oil & gas drilling rigs running across Montana and North Dakota. The rigs referred to in this article are for ALL drilling reported by Baker Hughes and not solely wells targeting the Bakken formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count.

Read more at bakerhughes.com

Bakken Shale Rig Count Down Two

Bakken Rigs

The Bakken-Three Forks rig count fell by two this week landing at 27 rigs running across our coverage area by midday Friday.

A total of 443 oil and gas rigs were running across the United States this week, which is a drop of seven over last week. 89 were targeting natural gas (one more than the previous week) and 354 were targeting oil in the U.S. (eight less than the previous week). The remainder were drilling service wells (e.g. disposal wells, injection wells, etc.) 27are in ND alone.

Bakken Oil & Gas Rigs

The Bakken oil rigs were at 27 this week with Bloomberg reporting WTI oil prices trading at $36.79 on Friday afternoon. WTI-Brent held steady at $41.94. The Bakken has zero natural active gas rig in the area this week with futures increasing to $1.99/mmbtu by midday.

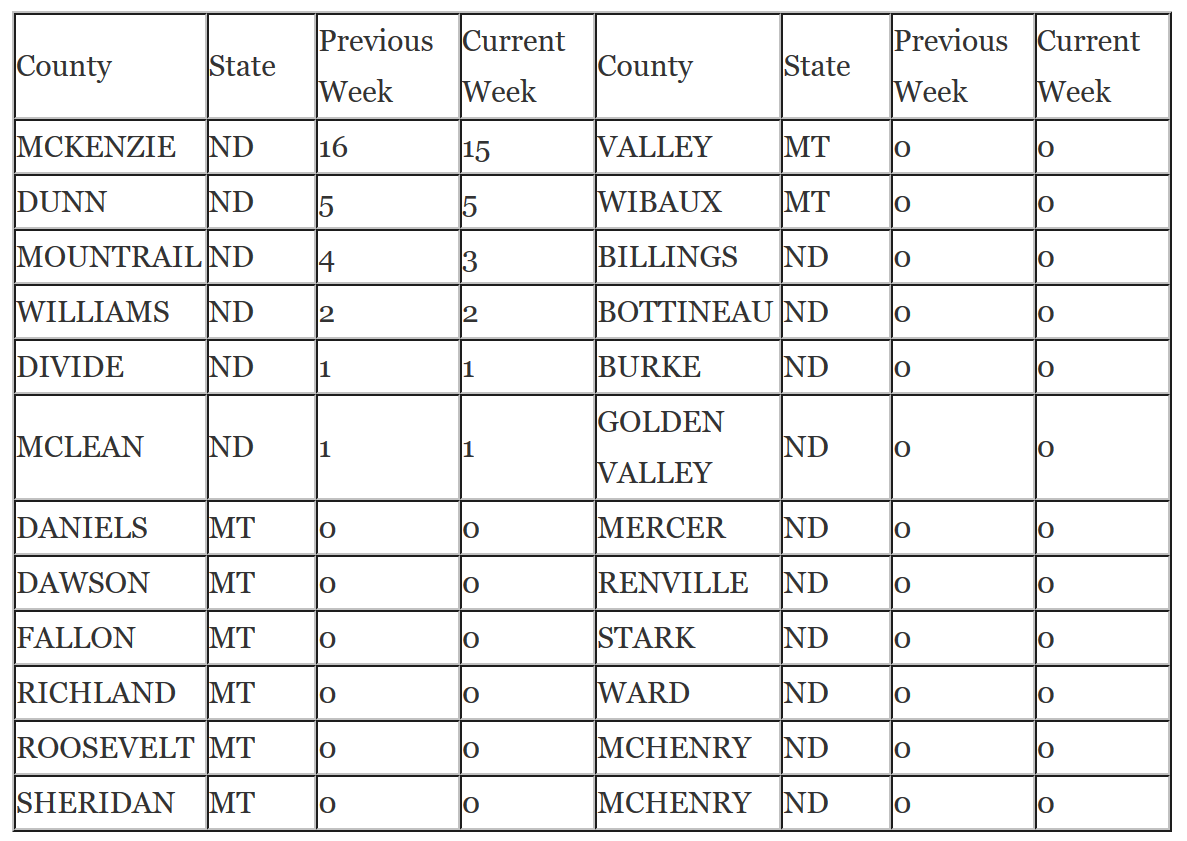

McKenzie County continues to lead development with 15 rigs running this week, far outpacing other counties. View the full list below under the Bakken Drilling by County section.

Activity continues to be dominated by horizontal drilling:

- 27 rigs are drilling horizontal wells

- 0 rigs are drilling directional wells

- 0 rigs are drilling vertical wells

Bakken Drilling by County

What is the Rig Count?

The Bakken Shale Rig Count is an index of the total number of oil & gas drilling rigs running across Montana and North Dakota. The rigs referred to in this article are for ALL drilling reported by Baker Hughes and not solely wells targeting the Bakken formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count.

Read more at bakerhughes.com

Tesoro Buys Bakken Midstream Assets

Tesoro increases its presence in the Bakken with the purchase of strategic midstream assets.

Related: Tesoro Buys QEP's Bakken Pipeline Assets - $2.5 Billion

Tesoro Corporation announced earlier this month that it will grow its midstream operations to provide more efficient, flexible and cost-effective integrated logistics services to customers in the Bakken region. They will acquire Great Northern Midstream LLC and will gain pipelines, gathering systems, transportation, storage and rail loading facilities in the Williston Basin of North Dakota.

Greg Goff, Chairman, President and Chief Executive Officer of Tesoro Corporation commented that, "Combining the Great Northern Midstream assets with our Tesoro High Plains Pipeline will create a leading crude oil pipeline system in the most prolific region of the Bakken."

The transaction includes the 97-mile BakkenLink crude oil pipeline, a proprietary 28-mile gathering system and a 154,000 barrel per day rail loading and a 657,000 barrel storage facility in Fryburg, North Dakota.

In late 2014, Tesoro purchases QEP Resources Inc.’s natural gas pipeline and processing business, QEP Field Services, which brought with it 2,000 miles of natural gas and crude oil gathering and transmission pipeline, with locations in North Dakota’s Bakken Shale and the Rocky Mountain region. The assets have have a combined 2.9 billion cf/d of natural gas and 54,000 b/d of crude oil throughput capacity.

The terms of the Great Northern deal are not public, but Tesoro said the acquisition price represents five to six times Tesoro-estimated future EBITDA for the Great Northern Midstream business. The transaction is expected to close early in 2016.

Read more at tesorologistics.com