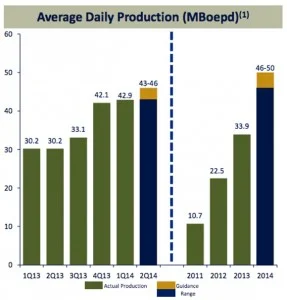

Oasis Petroleum is on track to reach the low end of its estimated 2014 daily production target of 46,000 boe/d in the second quarter of the year. Current production estimates for Oasis' second quarter production are between 43,000 boe/d - 46,000 boe/d.

During the first quarter of 2014, the company's total production was 42,856 boe/d. That figure represents production growth of approximately 5% quarter over quarter for the company.

To help achieve its production targets, Oasis will continue slickwater tests, after seeing a 25% production uplift in three of its core operating areas. Specifically, these areas are Indian Hills, Foreman Butte, and Red Bank. Oasis says it now intends to complete 20% of wells during the second half of 2014 with the slickwater technique.

“Oasis CEO Thomas B. Nusz, said, “based on encouraging results to date from slickwater tests and other completion technology, we intend to complete over 60% of our wells in the second half of 2014 with alternative completion techniques. We are focused on designs that may increase production or reduce costs, ultimately driving higher per well and per drilling spacing unit returns.”

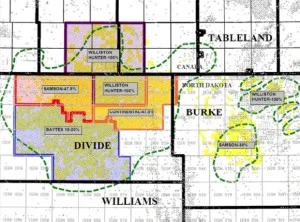

During the first quarter, Oasis completed the sale of certain non-operated properties in its Sanish project area and other adjacent non-operated properties on March 5, 2014 for cash proceeds of $321.9 million. Properties ear-marked in the sale were 8,354 net acres and 28.2 net producing Bakken and Three Forks wells. Production from the properties was 2,691 boe/d during Q4 2013.

Read more: Oasis Sells Bakken Acreage - Strong Production Growth in 2014

Also during the first quarter, the company picked up an additional rig, and anticipates a sixteenth rig after the spring. The company says a majority of its rigs will be operating on pads through the spring.