Halcon is focused on drilling wells in the Fort Berthold area in 2014 and anticipates spending approximately 49% of its total drilling and completions budget in the Williston Basin. Based on previous budget estimates, that's about ~475 million.

Read more: Halcon Holds Production Guidance & Lowers its 2014 Capital Budget

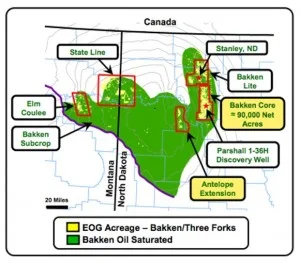

The company's plan for 2014 is to focus on its "de-risked" acreage, which includes the Fort Berthold area.

“Floyd Wilson, CEO, said in a company statement, “our focus in 2014 is on drilling wells in the sweet spots of our de-risked acreage in the Williston Basin and El Halcón. We will also begin drilling wells on our newly acquired acreage located in what we believe to be the core of theTuscaloosa Marine Shale. We are primed for growth and have a deep drilling inventory. We are committed to maintaining capital discipline and dedicated to improving capital efficiency.”

Halcon's 2014 Bakken Guidance

In the first-quarter of 2014, Halcon anticipates weather-related production interruptions in the Bakken.

For the full-year, the Company plans to operate an average of 4 rigs and spud 40 to 50 gross operated wells. Halcon also anticipates participating in 200-225 gross non-operated wells, with an average working interest of 3%.

Halcon's Fourth-Quarter Bakken Production

In the fourth-quarter of 2013, Halcon Resource's Bakken production increased by 15% over the third-quarter to 24,125 boe/d, despite adverse weather conditions. Company estimates accounted for weather-related impacts of ~1,040 boe/d.

Halcon's Fourth-Quarter Bakken Activity

Halcon operated an average of five rigs in the Bakken, and participated in 50 non-operated wells, with an average working interest of 3% in the fourth-quarter of 2013.

In the Fort Berthold area, the company spudded eight wells and broutght 10 wells online. For some of Halcon's Fort Berthold area wells, strong results came from the application of the "slickwater frac" technique. The company plans on continuing this practice in 2014.

“At Winter NAPE, Wilson, was quoted, “[the company’s] most recent wells in the Bakken are the best ever.”

Halcón also spudded four wells and put two wells online in Williams County in the fourth-quarter.

Read more at halconresources.com