The Bakken and Three Forks region are on the verge of joining an elite fraternity that only ten (10) other oilfields in the world have enjoyed - the 1-million b/d club.

Daily production in the Bakken and Three Forks region of North Dakota continues to grow at a rapid pace.

The month of November certainly indicated that the 1-million b/d target seems to be well within reach, with 908,384 b/d coming from the Bakken and Three Forks in North Dakota alone, and also accounting for 93% of state-wide production. Total state-wide production in November accounted for 973,045 b/d. For more on the most up-to-date statistics on the Bakken and Three Forks region, see the North Dakota Industrial Commission (NDIC) Director's Cut for January.

Read more:North Dakota Production will Exceed 1 Million b/d in Early 2014.

In-line with the state-wide increase in production, North Dakota set an all-time record high for the number of producing wells with 10,023. The state has 10,000 producing wells for the first time ever!

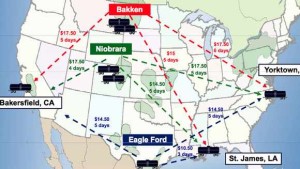

Williston Basin Sweet Crude prices are down over the past few months. The price quoted in the directors cut dropped from $85.16/barrel in October to $71.42 in November. Prices have remained relatively flat however since then.

Quick Glance:

- Oil production up to 973,045 b/d in Nov from 945,182 b/d in Oct

- Gas production estimated at 1.08 Bcf/d with 30% flared in November

- Flaring was up 2% due to a Tioga Plant closure during the month

- Permitting has held flat at ~230 per month in Nov and Dec

- Williston crude prices are down Oct = $85.16/bbl, Nov = $71.42/bbl, Dec = $73.47/bbl

- Natural gas prices delivered to the Northern Border Pipelin at Watford city are up to $3.86/mcf

- 10,023 wells producing in the state

- Average ND rig count up from 184 in Nov to 190 in Dec

Read more at dmr.nd.gov