BP's Bob Dudley addressed the crowd at IHS CERAWeek to share expectations of what he deemed "challenging opportunities" in the oil and gas industry. His points of emphasis were growth in both North America and Russia. He highlighted "spectacular" growth here in the US.

BP's CEO Bob Dudley stated "Gas production will be the fastest growing fossil fuel at 2% annually. Oil will grow more slowly......But that still means the world will need around 16 million barrels per day more in 2030 than today....that increase alone is nearly the combined daily 2011 production of Russia, Canada, and the UAE"

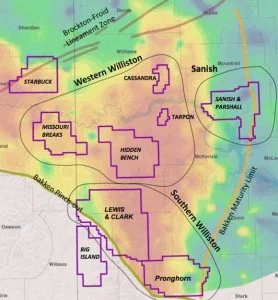

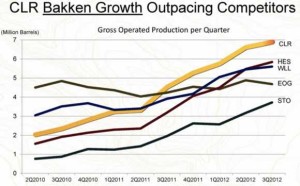

Non-fossil energy will grow faster as a group, but will still only account for 1/5th of all energy in 2030. To no surprise, BP has a view that oil and gas are here to stay. Oil production needs to grow substantially through the next two decades and shale plays like the Bakken will fill the void.

Notes from Dudley's speech include:

- US oil production is above 7 mmbbls/d, from 5 mmbbls/d in 2008

- Both the Gulf of Mexico and Alaska are producing longer and more than thought

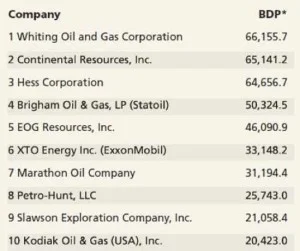

- ND has grown from 100,000 b/d of oil in 2006 to over 750,00 b/d at year-end 2012

- ND production surpassed Alaska for #2 in the US and now produces more than OPEC member Ecuador

- US has been successful due to privatized mineral rights and incentives for entrepreneurs

- Oil & gas employment has risen 27% in the US since 2008 "It is a great renaissance"

- Import dependence is falling

- BP spent 35 years attempting to make solar work and was never able to turn a profit

Follow us on twitter @BakkenShaleNews for live updates from the conference.