Targa Resources and Saddle Butte Pipeline have agreed to a $950 million deal that includes the Williston Basin crude oil pipeline & terminal, as well as its natural gas gathering and processing operations.

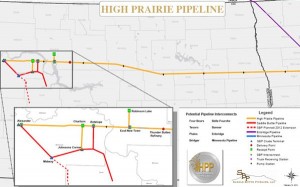

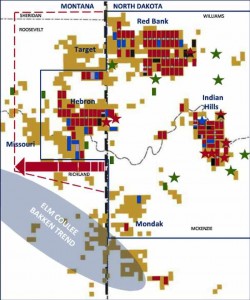

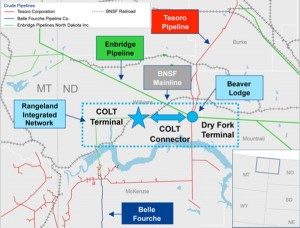

The deal centers around 155 miles of crude oil pipelines in Dunn, McKenzie, and Mountrail counties in North Dakota. The related terminals have a planned 70,000 barrels of storage capacity. The Johnsons Corner Terminal is being expanded from 20,000 to 40,000 barrels and the Alexander Terminal has capacity of 30,000 barrels. In terms of gas assets, the deal includes 95-miles of gathering lines and a 20 mmcfd processing plant that is being expanded to 40 mmcfd.

"This acquisition of a major, strategic midstream business complements our extensive portfolio of midstream assets, extends our footprint to the very attractive Bakken Shale play, further diversifies our business with the addition of crude oil gathering, and adds significant long-term growth in fee-based revenues," said Joe Bob Perkins, CEO. "We are very excited to expand our geographic footprint into one of the most important oil producing basins in the country. The visible, long-term growth potential of this business complements our attractive portfolio of ongoing and future organic growth projects and enhances the Partnership's longer term distribution growth."

Targa Resources also expects to spend $250 million to complete current expansions and to grow to meet industry needs in 2013. The company plans to fund the deal with 50% equity and 50% debt.