North Dakota could be home to a new $1-1.5 billion fertilizer plant. Norther Plains Nitrogen has proposed building the plant near Grand Forks, ND.

The project could use Bakken natural gas to produce 2,200 tons of ammonia per day.

Corn production in the region has grown significantly over the past decade and most nitrogen fertilizer used in the area is imported. Capital costs, electricity, water supply, and natural gas prices are a few important metrics in making the facility competitive.

NPN CEO Don Pottinger notes, "this green-field world-scale production facility will be among the safest, most efficient and environmentally compliant ever constructed. By using modern technology which, among other benefits, reduces our carbon footprint, the NPN facility is taking shape to be a very exciting and worthwhile undertaking."

Natural gas from the Bakken might provide a cheap way to supply hydrogen for use in the plant. Natural gas accounts for approximately 80% of the cash costs of producing ammonia. The plant is designed to consume ~80 mmcfd.

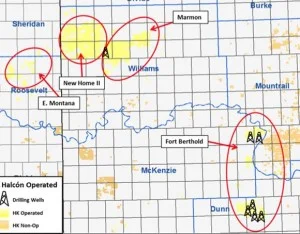

Bakken production is on pace to eclipse 1 million barrels per day of oil and 1 bcf per day of natural gas in the next 18 months. Approximately 30% of gas production in the Bakken region is flared, so a new source of demand will be welcomed by operators.

While the gas is expected to be produced, getting it to eastern North Dakota is not quite as easy. A pipeline will be needed to move any significant volume of natural gas across the state or the plant will only be indirectly supplied by the Bakken. The facility is connected to the Viking Gas Transmission System. The Viking system just happens to be the destination for a Bakken natural gas pipeline proposed by WBI Energy. If the pipeline goes forward, it is expected to be in service in 2016.

The developers hope to have the fertilizer plant online in time for the 2017 growing season.

You can read more about the project at norternplainsnitrogen.com