QEP Resources produced approximately 17,000 boe/d from the Bakken and Three Forks in the first quarter. That's down from more than 18,000 boe/d in the fourth quarter of 2012.

QEP has moved to pad drilling across much of its acreage and that means longer lead times before wells are brought to production.

No alarms should be going off here. Single wells that would have come online a short time after being drilled now have to wait until three wells are drilled and ready for completion on the same pad. Expect to see similar results from other Bakken operators who are transitioning to pad drilling throughout 2013.

Bakken and Three Forks Development Plans

QEP plans to drill eight wells per unit from two four well pads at the company's South Antelope area. Four wells will target the Bakken and four will target the Three Forks. Pad drilling will be the primary means of development in the South Antelope area.

During the quarter, only one well was turned to sales in the South Antelope area and 11 were turned to sales in the Fort Berthold area. You can read more about the South Antelope acreage in the article - QEP and Helis Reach Bakken Deal For $1.3 Billion

The 11 wells at Fort Berthold include two five well pads that yielded almost 2,200 boe/d and 2,500 boe/d per well on each pad, respectively. QEP's water gathering system is also running at Fort Berthold and the company is saving $5 per barrel in transportation costs.

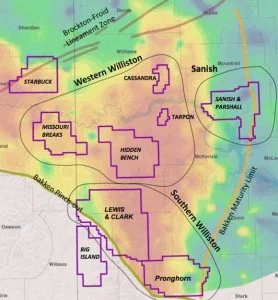

QEP expects all in well costs to hold below $11 million as the company transitions to pad drilling. Currently, three rigs are running at Fort Berthold and four rigs are running on the South Antelope properties. QEP has approximately 117,000 acres prospective for the Bakken Shale.