Northern Oil & Gas had an exceptional year in the Bakken. The company grew production 95% or from just under 2 million boe in 2011 to 3.76 million boe in 2012. That equates to daily production of more than 10,000 boe/d in 2012. Production growth was the result of Northern participating in the drilling of 42.8 net wells and bringing 48.3 net wells to production at a cost of $485 million.

Michael Reger, CEO, commented: "2012 was a year of operational transition in the Williston Basin. Throughout the year, drilling costs peaked and abated, wellhead price differentials peaked and subsequently improved to some of the play`s best levels and operators began the transition to pad drilling.

Bakken reserves grew 44% to 67.6 million boe in 2012. Approximately 55% are classified as proved and undeveloped

The company realized an average oil price differential of $9.79 per barrel in 2012, which compares to $6.30 in 2011. Differentials are expected to trend lower in 2013 as WTI prices trade lower than current Bakken markets that can be reached by rail on the East Coast and West Coast.

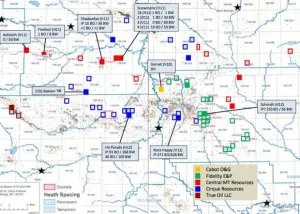

[ic-r]Northern held approximately 179,131 net acres in the Williston Basin as of year-end 2012. That total grew during the year as the company spent $37 million acquiring acreage:

- 17,590 net mineral acres at a cost of $1,788 per acre- $31.5 million

- 3,404 net mineral acres at a cost of $1,082 per acre - $3.7 million

- As well as earning 6,450 net acres through farm-ins.

An estimated 64% of the company's acreage is held by production.

2013 Bakken Capital Budget

Northern plans to spend between $420-440 million in 2013. Approximately $370-390 will be spent on drilling and completing wells and an estimated $20 million will be spent on acreage acquisitions. Plans call for the drilling and completion of 44 net Bakken and Three Forks wells.

Production is expected to grow 3,000 boe/d to 4.7-5 million boe for the year. The benefits of multi-pad drilling are expected to be realized in the second half of 2013.