Continental Resource's Bakken story keeps getting better and better.

The company reported fourth quarter and full-year 2012 earnings with news of soaring production, falling well costs, and better oil price expectations.

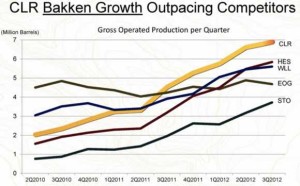

Continental's Bakken Production Continues to Outperform

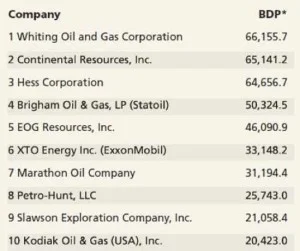

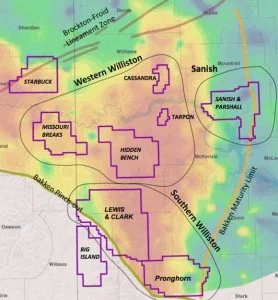

Continental Resources' Bakken production grew 64% from the fourth quarter of 2011 to the fourth quarter 2012 average of 67,522 boe/d. The Bakken and Three Forks now account for over 63% of company-wide production. Continental drilled a total of 259 gross wells with 21 rigs running in 2012. Operations drove proved reserve estimates to 564 million boe at the end of 2012. That's almost double what was booked at year-end 2011 and is what drove us to ask Will Continental's Reserves Cross 1 Billion boe in 2013?

Company operated wells averaged initial production rates of 1,187 boe/d in in North Dakota and 655 boe/d in Montana in the fourth quarter of 2012. Those results fall in line with the company's EUR estimates of 603,000 boe in ND and 430,000 boe in MT.

The second bench of the Three Forks yielded yet another impressive well. The Angus 1-9H flowed at 1,556 boe/d at 3,200 psi in a one day test period.

Bakken Well Costs Are Falling

Continental is entering full development mode on much of its acreage and is pushing operational efficiencies. The most recent improvements in cost are the result of faster cycle times, lower completion costs per stage, and pad drilling. Continental improved its per rig performance to 12 wells per rig in 2012. That's up from just seven wells per rig in 2011.

The most recent six well pad, named the Florida-Alpha project, was completed for $46.8 million or $7.8 million per well. That's well below the company's year-end 2013 target well costs.

Mr. Bott said. "Pad drilling is the future for full-field development, and, given our transition to more pads, we are on track to meet our goal of reducing average operated well costs in the Bakken to $8.2 million per well by year-end 2013, a reduction of $1 million per well in early 2012."

Bakken Oil Prices Are Improving

Continental's oil price differential to NYMEX prices decreased to $3.24/bbl in the fourth quarter of 2012.

Rick Bott, COO, stated, "We now expect average oil differentials in 2013 will be $5 to $7 per barrel....2012 saw fundamental changes in U.S. oil markets, with Bakken crude shipped directly to all major U.S. refining centers and making progress, we believe, toward becoming a national benchmark crude," he said. "Refiners on the East, Gulf and West coasts value the consistently high quality of sweet Bakken crude and the fact that supply from the basin continues to grow.

The expectation for differentials that average just $5-7/bbl is a sharp improvement from prior guidance of $8-11/bbl.

Read the full press release at contres.com