Oneok Partners announced plans to invest more in Bakken processing infrastructure in North Dakota.The company will spend $325-360 million to build the Garden Creek III plant in McKenzie County, ND. The plant will be built near the 100 mmcfd Garden Creek I and the 100 mmcfd Garden Creek II plants.

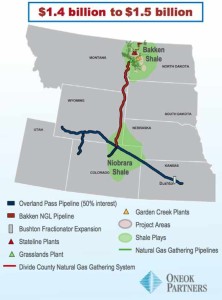

Oneok has already spent or has plans to spend $2.1-2.3 billion on natural gas processing and gathering investments related to the Bakken. The latest round of projects also includes expansion of NGL facilities in Kansas that will allow the company to handle even greater volumes of Bakken liquids. Total Bakken investments for Oneok will easily exceed $2.5 billion.

The partnership's previously announced Stateline II natural gas processing plant is expected to be in service during the first quarter of 2013. When completed, the natural gas processing capacities of the Garden Creek II and III plants, and the Stateline II plant combined with the existing Garden Creek, Stateline I and Grasslands natural gas processing facilities will be 590 mmcf/d in the Williston Basin.

This will be the sixth plant planned/operated in the Williston Basin by Oneok:

- Grasslands (90 mmcfd)

- Garden Creek I (100 mmcfd) online December 2011

- Stateline I (100 mmcfd) completed September 2012

- Stateline II (100 mmcfd) expected completion Q1 2013

- Garden Creek II (100 mmcfd) expected completion Q3 2014

- Garden Creek III (100 mmcfd) expected completion Q1 2015